SLM Partners launches global impact report to mark 10 years of ecological land investing

May 2021

SLM Partners is an asset manager that acquires and manages rural land on behalf of institutional investors to deliver environmental goals and financial returns.

SLM Partners has launched its first global Impact Report, marking ten years of pioneering investments in ecological farming and forestry systems. SLM Partners seeks to deliver market-rate financial returns by investing in real assets, while generating positive impacts on soil health, water, biodiversity and carbon storage, and building resilience to climate change and other risks. The company’s overarching mission is scaling up of regenerative land management that enhances natural capital.

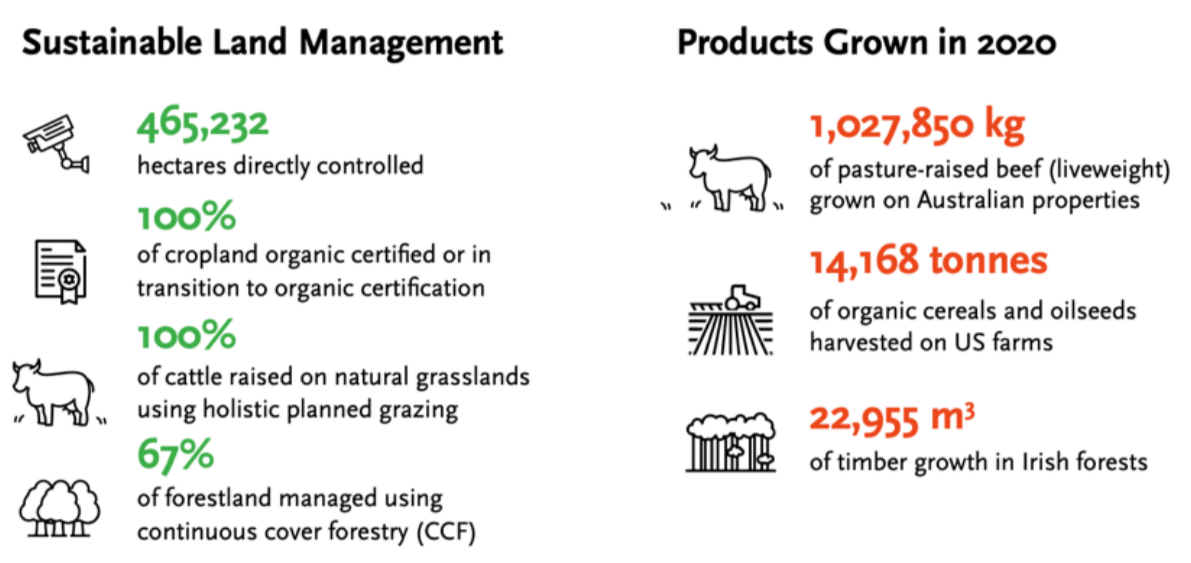

With US$210 million in assets under management at the end of 2020, SLM Partners has developed and implemented three investment strategies across three continents focused on grass-fed beef, organic grains and continuous cover forestry.

In Australia, the SLM Australia Livestock Fund has acquired and now manages 450,000 ha of grazing land for beef cattle production. These properties are also generating and selling 250,000 tonnes of verified CO2 credits annually. In Ireland, the asset manager raised a €30m fund (the SLM Silva Fund) that has acquired more than 50 forest properties for conversion to continuous cover forestry management. In the USA, SLM Partners manages separate accounts focused on scaling up organic certified farming, especially for organic grains.

Key Impacts (2020)

The newly published Impact Report describes how SLM Partners integrates impact into the core of its investment strategies, from design to implementation. It also explains the asset manager’s approach to impact measurement. SLM Partners collects property-level data on outcomes that are specific to each strategy and applies third-party certifications where relevant. The team then aggregates and presents this data through globally-accepted impact reporting frameworks and metrics, such as the Global Impact Investing Network’s IRIS+ and the UN Sustainable Development Goals. This work is aligned with relevant regulatory and financial sector initiatives that are increasingly bringing focus to sustainability risks and impact claims.

The report also describes the ways in which SLM Partners continues to enhance its impact measurement and reporting as it develops new strategies. “In order to ensure a more dynamic and independent approach to evaluate the impact risks and opportunities associated with our investments, we will require an extra level of rigour and disclosure which will also benefit investors and a wider set of stakeholders,” Augusto Semmelroth, Vice President of SLM Partners, explains.

SLM Partners is currently developing a pan-European regenerative land management fund that will invest in forestry and permanent crops across multiple EU countries. The company is also continuing to expand its organic farmland investments in the USA.

“We started this business in 2009 because we saw the potential to deliver both environmental benefits and financial returns by investing in natural capital,” said Paul McMahon, Managing Partner of SLM Partners. “We are more convinced than ever that this approach can help investors meet their commitments to action on climate and biodiversity.”

ABOUT SLM PARTNERS

SLM Partners is an asset management firm that invests in agriculture and forestry strategies that deliver attractive risk-adjusted returns and positive environmental impacts. Founded in 2009, it manages funds and separate accounts in Australia, Ireland and the USA. At the end of 2020, the company had $210m in assets under management and managed 465,000 hectares of farmland or forestry. SLM Partners is registered as an Alternative Investment Fund Manager with the Central Bank of Ireland and the UK Financial Conduct Authority.